What is the tax code (Vergi Nomara) in Turkey and how to get it?

If you intend to receive a Kimlik card or any activity as a tourist or immigrant in Turkey, you need a tax code in Turkey.

In general, Turkey does not have very strict rules for those who intend to invest and live in this country, but you need to do everything legally.

One of the most important and basic documents will be the tax code, which is called Nomarasi in Turkish.

This code is needed to perform any financial and economic activity.

From buying a SIM card in Turkey and registering for it to buying a property in Turkey, getting a loan or starting a business, opening a bank account and getting a Visa or MasterCard bank card… you will need a tax code.

Tax code for opening a bank account

As mentioned above, if you intend to live and stay in Turkey, you will have to activate a tax code. Your information is issued in your name as a real person.

This work will be done once and can be used in all economic institutions and offices.

Just like a password or the same national code that is used in Iran to identify people for all kinds of registrations.

Documents for receiving the tax code:

1- Original and copy of passport

2- Filling the relevant forms

3- Turkish active SIM card

How to get the tax code:

You can get this code in Turkey by going to the tax office of any city, but from 2022 you can get the tax number online by filling out the relevant form in less than 1 minute, and there will be no need to go to the tax office. And definitely, soon, receiving tax codes will be only through the website of the tax department and online.

For this, you should go to the website of the tax office and complete the relevant form, and finally the site will give you a PDF file that you need to print and register its number in your mobile phone.

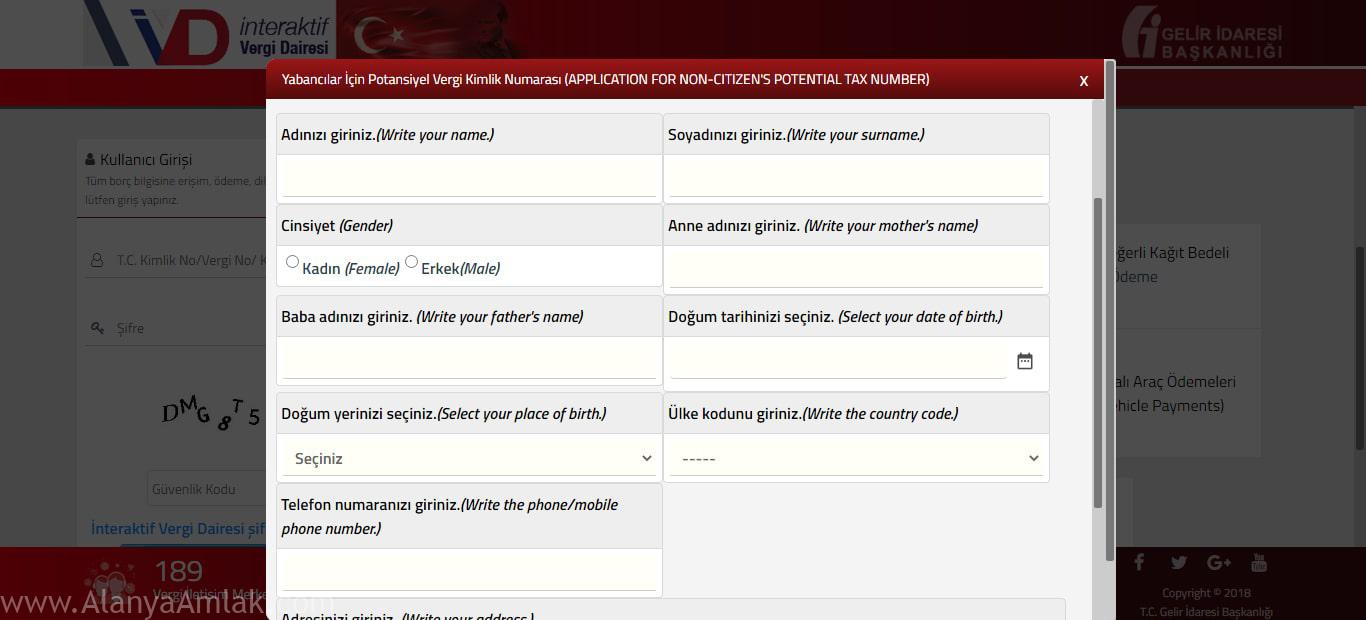

Completing this form is very simple and it only requires a little care to enter and save your passport information, residence information and Turkish mobile number correctly.

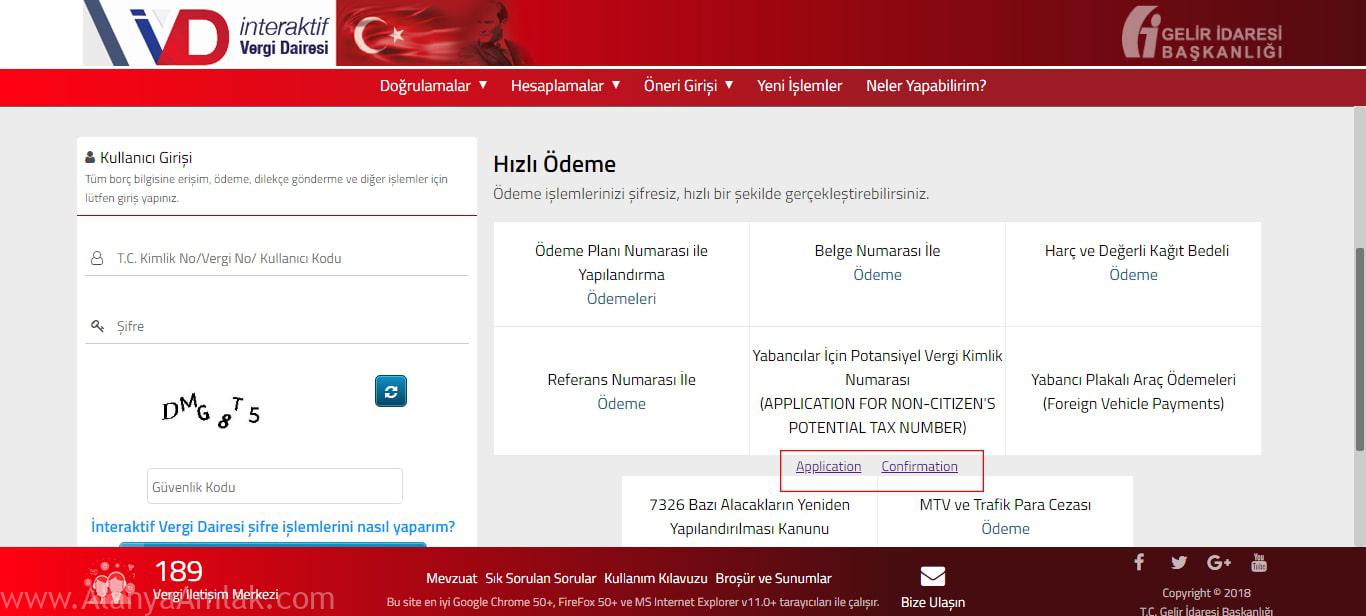

In the image below, you can see the initial page that you enter on the website of the tax office, where you have to click on the word APPLICATION to open the form, also if for any reason you did not see your tax code after obtaining it, or the page is closed or If you lost it, by visiting the site again and clicking on CONFIRMATION, you can re-enter your main information and print again from the site.

In the next picture on this page, you can see a part of the relevant form to receive the tax code, which is both in Turkish and English, and after completing it and saving the form, your tax code will be issued.

Receive tax code for Turkish residence

One of the documents required to obtain Turkish residence is the Nomarasi form or the tax code.

After receiving this code, you can pay the land fee and other fees.

The tax code obtained in any city in Turkey is valid in other cities as well.

Location of Alanya City Tax Office:

Contact us

Please fill out the following form so that our experts will contact you as soon as possible: